In the world of forex trading, selecting the right trading company can significantly impact your trading outcomes and overall success. The forex market is the largest and most liquid financial market in the world, where trillions of dollars are traded daily. Thus, the importance of aligning yourself with a robust and reputable forex trading company forex-vietnam.net cannot be overstated. This article will explore various factors to consider when choosing a forex broker, the benefits of a reliable trading platform, and essential tips to enhance your trading experience.

Forex trading companies, also known as forex brokers, act as intermediaries between traders and the forex market. They provide access to trading platforms, tools, and resources that enable individuals and institutions to buy and sell currencies. When choosing a forex trading company, it is crucial to evaluate several aspects such as regulation, trading conditions, fees, and the available trading tools.

The first thing to check when selecting a forex trading company is whether it is licensed and regulated by a reputable financial authority. Regulatory bodies enforce strict guidelines to protect traders and maintain fair trading practices. Trading with a regulated broker gives you confidence that your funds are secure and that the broker operates under stringent standards. Major regulatory bodies to consider include the Financial Conduct Authority (FCA) in the UK, the National Futures Association (NFA) in the US, and the Australian Securities and Investments Commission (ASIC).

Different forex brokers offer various trading conditions, including spreads, leverage, and margin requirements. It’s essential to compare these conditions as they can significantly impact your trading profitability. Additionally, many brokers charge commissions and fees that can affect your overall returns. Understanding the cost structure of each forex trading company you are considering is important. Look for brokers that offer competitive spreads and low commission fees while maintaining high-quality service.

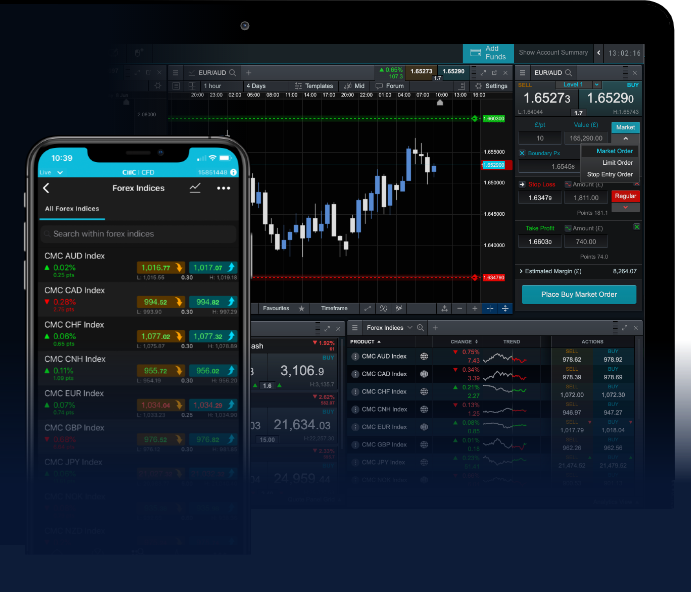

The trading platform provided by a forex broker plays a crucial role in your trading experience. Popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer a range of features, including advanced charting tools, technical indicators, and automated trading capabilities. When choosing a forex trading company, ensure that their platform is user-friendly, reliable, and offers the necessary tools to support your trading strategies.

Choosing a reputable forex trading company comes with several advantages that can significantly enhance your trading experience and outcomes. Here are some of the key benefits:

Many reputable forex brokers provide educational resources and materials to help traders improve their knowledge and skills. These resources can include webinars, tutorials, and articles that cover various topics, from basic forex trading concepts to advanced strategies. Access to educational tools can empower traders, especially beginners, to make informed decisions and develop effective trading plans.

Another important aspect of a reliable forex trading company is its customer support. A good broker will offer various channels for support, including live chat, email, and phone options, ensuring that assistance is readily available. Prompt and efficient customer service can help resolve issues quickly and enhance overall satisfaction with your trading experience.

Many forex trading companies offer demo accounts that allow traders to practice their skills without risking real money. A demo account simulates the live trading environment, providing a risk-free platform for individuals to develop their strategies, test trading platforms, and get comfortable with market dynamics before committing real funds. This feature is especially beneficial for novices eager to learn and gain confidence in their trading abilities.

Choosing the right forex trading company is just one aspect of successful forex trading. Here are some additional tips to help you optimize your trading performance:

Successful traders understand the importance of having a well-defined trading plan. Your plan should outline your trading goals, risk tolerance, preferred trading strategies, and criteria for entering and exiting trades. Adhering to your plan will help you remain disciplined and reduce the influence of emotions on your trading decisions.

Risk management is a key component of successful trading. Always use stop-loss orders to limit potential losses and avoid risking more than you are willing to lose on any single trade. Diversifying your trading portfolio and staying informed about economic events and market trends can also help you manage risk effectively.

The forex market is constantly evolving, and successful traders are those who adapt to changes and stay updated on market developments. Regularly investing time in educating yourself, whether through reading, joining trading communities, or attending workshops, will sharpen your trading skills and prepare you for various market conditions.

In conclusion, choosing the right forex trading company is a vital step that can have a lasting impact on your trading journey. By evaluating brokers based on their regulation, trading conditions, platforms, and available resources, you can make informed decisions that align with your trading goals. Coupled with a structured trading plan and risk management strategies, a reliable forex trading company can set you on the path to success in the dynamic world of forex trading.

The Ultimate Guide to the Exness Economic Calendar The Exness Economic Calendar is a powerful tool ...